What Are the Corporate Income Tax Reliefs Available to Me?

Singapore has one of the lowest corporate income tax rates. This is made even more advantageous for businesses in Singapore as the government provides several incentives to promote entrepreneurship in Singapore. Collaborating with IRAS, tax reduction schemes has been implemented to help ease the costs of running a company.

Tax Exemption Scheme for New Start-Up Companies

To encourage entrepreneurship and help start-ups grow and establish a base in the country, the Start-up Tax Exemption Scheme (SUTE) was introduced, providingnewly incorporated qualifying companies exemption on their taxable profits in their first 3 years of operations. The table below shows the exemption amount for eligible start-ups.

| YA 2020 Onwards | YA 2010-2019 | ||

|---|---|---|---|

| Chargeable Income (SGD) | Tax Exemption | Chargeable Income (SGD) | Tax Exemption |

| First 100,000 | 75% | First 100,00 | 100% |

| Next 100,000 | 50% | Next 200,000 | 50% |

YA – Year of Assessment

Eligibility and Qualifying Conditions

This scheme is available to all start-up companies in Singapore, excluding any company whose:

- Principal activity is that of investment holding; or

- Principal activity is that of developing properties for sale, investment, or both.

Eligible start-ups must fulfil the following 3 conditions to qualify for the tax exemption:

- The company must be a company registered in Singapore.

- The company must be a tax resident for that assessment year in Singapore.

- The number of shareholders of the company must not exceed 20 in that assessment year.Among these individual shareholders, at least one of them needs to hold 10 percent or more of the company’s shares.

Partial Tax Exemption for Companies (PTE)

The Government recognises that smalland medium sized enterprises (SMEs) are also an important component of a vibrant economy. As such, the Government has put in place the PTE scheme designed tohelp such companies grow and establish themselves.

Companies that do not meet the qualifying conditions for SUTE would be eligible for the PTE.The table below shows the exemption amount that qualifying companies can enjoy.

| YA 2020 Onwards | YA 2010-2019 | ||

|---|---|---|---|

| Chargeable Income (SGD) | Tax Exemption | Chargeable Income (SGD) | Tax Exemption |

| First 100,000 | 75% | First 100,00 | 100% |

| Next 190,000 | 50% | Next 290,000 | 50% |

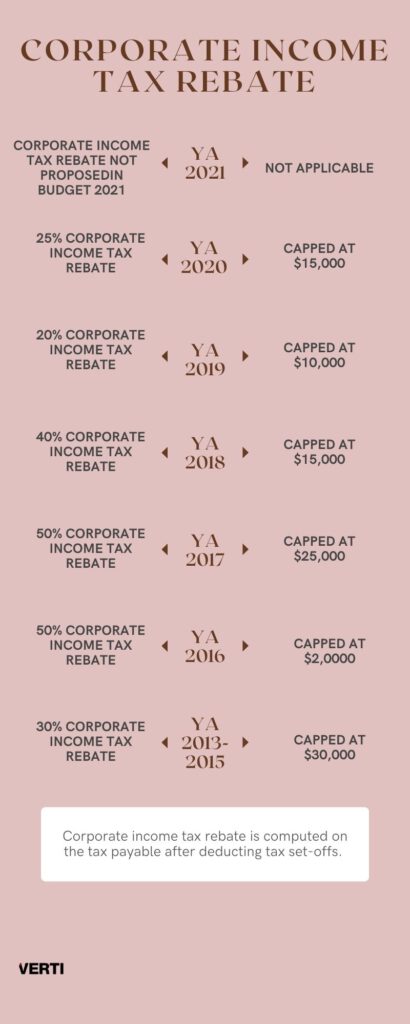

Corporate Income Tax Rebate

The corporate income tax rebate was introduced to help improve the cash flows of businesses and to support restructuring of companies.The infographic below summarises the corporate income tax rebate percentage and cap given for companies for YAs 2013-2021.

References

- https://www.iras.gov.sg/irashome/Businesses/Companies/Learning-the-basics-of-Corporate-Income-Tax/Common-Tax-Reliefs-That-Help-Reduce-The-Tax-Bills/

- https://www.iras.gov.sg/irashome/Businesses/Companies/Learning-the-basics-of-Corporate-Income-Tax/Overview-of-Corporate-Income-Tax/

- https://www.iras.gov.sg/irashome/Businesses/Companies/Learning-the-basics-of-Corporate-Income-Tax/Corporate-Tax-Rates–Corporate-Income-Tax-Rebates-and-Tax-Exemption-Schemes/