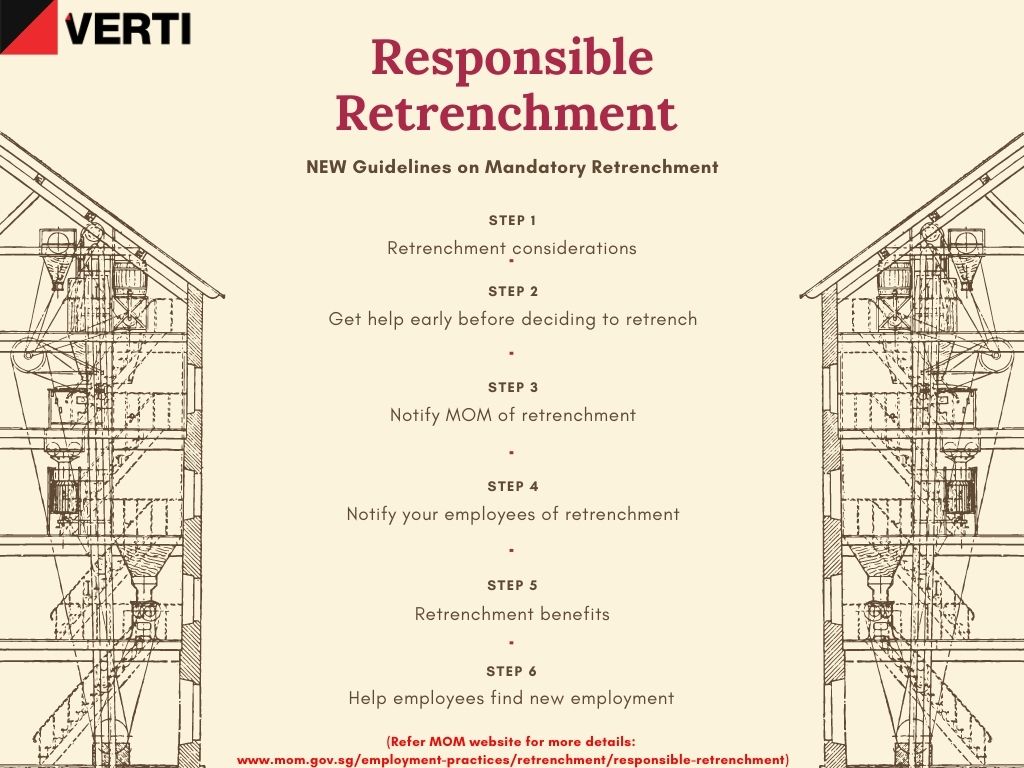

New Retrenchment Guidelines with Effect from 1 November 2021

Since Singapore’s first COVID-19 case, we have seen major changes in our daily life. Many businesses big or small started facing difficulties thus making losses and eventually wind up. Due to this, retrenchment rate started to increase significantly, and our government felt the need of putting in place a mandatory retrenchment guideline to help affected employees.

The government expect Employers who are retrenching employees to do so responsibly and fairly and at the same time consider these six steps:

1. Retrenchment considerations

As an employer, if you plan to retrench workers, you should do the following before you retrench:

- Take a long term view of your manpower needs, including the need to maintain a strong Singaporean core.

- Inform MOM before carrying out any retrenchment exercise.

- Consult with the union if your company is unionised.

- Not discriminate against employees or groups of employees and make your selection based on factors such as the ability to contribute to your company’s future business needs.

- Treat your affected employees with dignity and respect.

- Consider having a longer retrenchment notice period for all your affected employees.

During the retrenchment exercise, you should:

- Pay all salaries, including unused annual leave, notice pay, etc., to your employees on their last day of work.

- Help your affected employees look for alternative jobs in associate companies, other companies or through outplacement assistance programmes, e.g. job fairs, career fairs, career advice.

2. Get help early before deciding to retrench

If you need any of the following, you can submit an early alert to us:

- Get information on government assistance schemes to support your restructuring exercise.

- Understand how to apply the Tripartite Advisory on Managing Excess Manpower and Responsible Retrenchment.

- Get employment facilitation for your employees.

3. Notify MOM of retrenchment

With effect from 1 November 2021, If you have decided and will be going through a retrenchment exercise, you are strongly encouraged to submit a notice of retrenchment.

It is mandatory for employers with at least 10 employees who have retrenched 5 or more employees within any 6-month period to notify MOM of the retrenchment exercise.

4. Notify your employees of retrenchment

You must notify your employees of their retrenchment according to the terms for termination of employment in their contract of service.

5. Retrenchment benefits

Retrenchment benefits are payments given to employees to compensate them for the loss of employment.

Who is eligible

Employees who have served the company for at least 2 years are eligible for retrenchment benefits. Those with less than 2 years’ service could be granted an ex-gratia payment out of goodwill.

Amount of compensation

The amount of retrenchment benefit depends on what is provided for in the employment contract or collective agreement (for unionised companies). If there is no provision, it will have to be negotiated between the employees (or their union) and the employer.

The prevailing norm is to pay a retrenchment benefit of between 2 weeks to 1 month salary per year of service, depending on the company’s financial position and the industry.

In unionised companies where the amount of retrenchment benefit is stated in the collective agreement, the norm is 1 month’s salary for each year of service.

Note:

- If the retrenchment comes shortly after a salary cut, the salary before the cut should be used to determine the amount of compensation.

- Both employee and employer don’t have to pay CPF contributions for retrenchment benefits.

6. Help employees find new employment

You can work with unions, SNEF and agencies such as WSG, NTUC’s U PME Centre and e2i to help affected employees find alternative employment.

References