Taxability on Government Grants/Payout

There were many questions raised whether or not Government Grants/Payout are Taxable. Especially, since last April 2020 where many Grants/Payout are given to companies due to Covid 19.

In general, the guiding principle on taxability of grants/payout are:

- Grant/ payout will be taxable if it is given to supplement trading receipts or to defray operating expenses of the company (i.e. grant/ payout is revenue in nature)

- Grant/ payout will not be taxable if it is given for the purpose of acquiring capital assets of the company (i.e. grant/ payout is capital in nature)

As announced in Budget 2020, tax deductions and allowances (i.e. capital allowances, writing-down allowances and investment allowances) will no longer be given on expenditures funded by capital grants from the Government or Statutory Boards that are approved on or after 1 Jan 2021. For expenditures that are partially funded by capital grants, tax deductions and allowances will only be allowed on the net amount. This change seeks to eliminate double-incentivisation where the capital grants are not taxed while the expenditures funded by these grants are eligible for tax deductions and allowances.

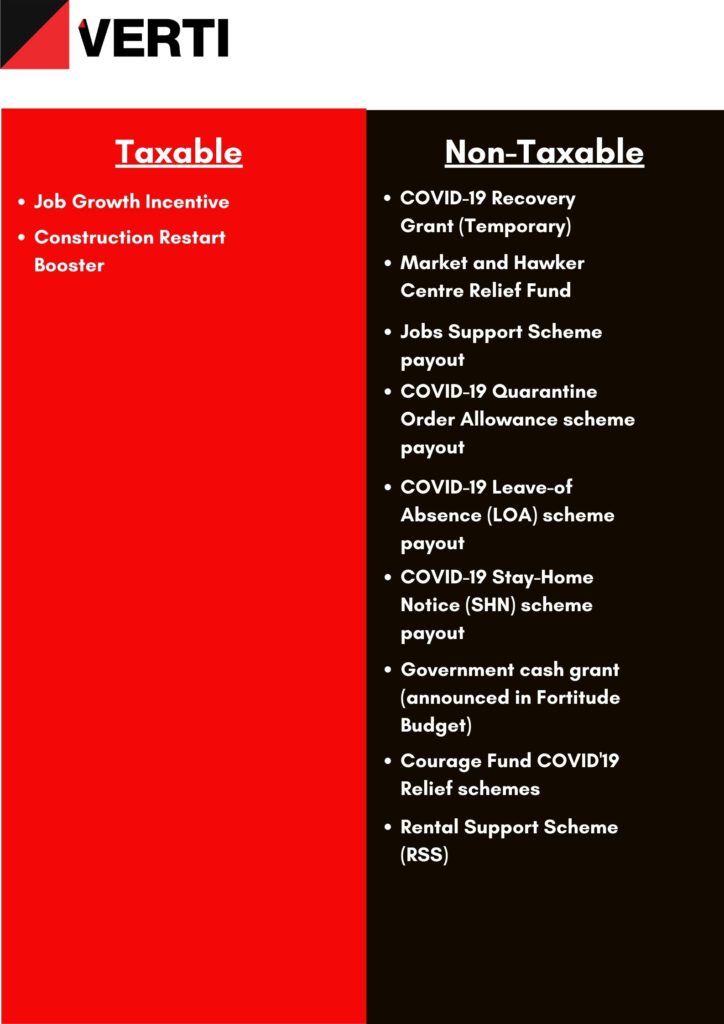

If you have applied for grants, you may refer to the Infographic below to check if the grants/payout are taxable or not.

References