Key Things to Note About Corporate Tax Filing

Every company is required to comply with the tax filing in Singapore. Under the scrutiny of IRAS, the corporate tax compliance has become more complex.Therefore, it is critical that companies stay abreast to the fast-changing and dynamic regulatory requirements.

There are 2 requirements to be filed each year, the estimated chargeable income (ECI) and the Corporate Income Tax Return.

Estimated Chargeable Income (ECI)

The ECI is an estimate of the company’s taxable income after deducting tax deductible expenses for a year of assessment (YA). It is to be filed electronically via myTax Portal within 3 months from the companies’ financial year end.Singapore-registered companies that submit their ECI within the qualifying period may opt to pay corporate taxes by instalments if they are on GIRO. The earlier a company files, the greater the number of instalments they will be given.

Companies that meet the following 2 criteria need not file an ECI:

- The company’s annual revenue is not more than $5 million for the financial year; and

- The ECI is NIL.

Corporate Income Tax Return

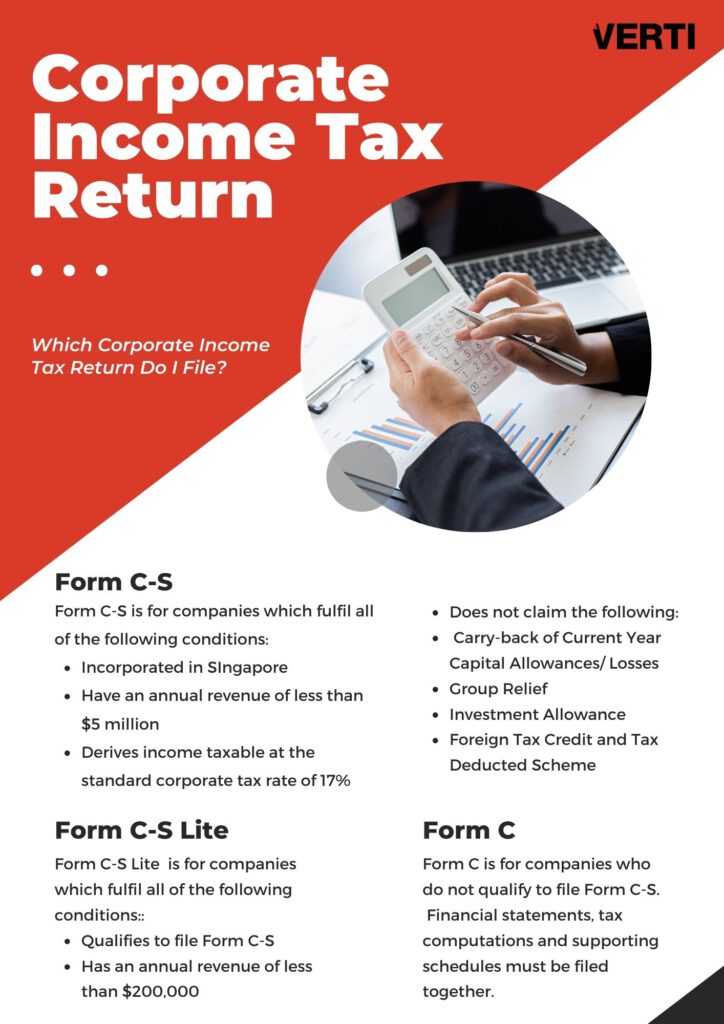

The infographic below tells you which corporate income tax return you should file, Form C-S, Form C-S Lite or Form C.

The Corporate Income Tax Return must be filed by all companies via myTax Portal before 30th November annually. This applies even to companies that are making losses, applying to be struck off or under liquidation.

Notice of Assessment (NOA)

After filing the necessary forms, IRAS will review the forms and then issue a Notice of Assessment (NOA) to the company by 31st May of the following year, indicating the amount of tax payable. Companies that do not agree with the tax assessment raised may file an objection to have the tax assessment revised within 2 months from the date of the NOA.The full tax amountwill have to be paid within 30 days of receiving the NOA regardless of whether you have filed an objection.

Consequences of Late/Non-Filing of Tax Returns

Tax filing is an important obligation for all companies and failing to do so could have serious consequences. IRAS may estimate a company’s income and issue an estimated NOA. The estimated tax must be paid within 1 month from the date of the NOA. A company failing to file a tax return can be fined for up to $1000 and or summoned to court. If the company fails to file for more than 2 years, an additional penalty of twice the amount of tax assessed may be imposed.

Penalties for Errors in Tax Returns

When the Corporate Income Tax Returns have been inaccurately filed without any intention to evade taxes IRAS could impose:

Financial penalties of up to 200% of the tax undercharged;

- Fines of up to S$5,000; and/or

- Imprisonment of up to 3 years.

When the tax returns have been filed inaccurately with the intention to evade taxes however, IRAS could impose:

- Financial penalties of up to 400% of the tax undercharged;

- Fines of up to S$50,000; and/or

- Imprisonment of up to 5 years.

Consequences of Late or Non-Payment of Corporate Tax

If your tax is not paid within 1 month of receiving the NOA, a 5% penalty will be imposed, with subsequent penalties of 1% imposed for each month the tax remains unpaid, up to a maximum of 12% penalty.

IRAS may also take further enforcement or legal actions to recover the unpaid tax.

References

- https://www.iras.gov.sg/irashome/Businesses/Companies/Filing-Estimated-Chargeable-Income–ECI-/Definition-of-Estimated-Chargeable-Income–ECI–and-When-to-File/

- https://www.iras.gov.sg/irashome/Businesses/Companies/Learning-the-basics-of-Corporate-Income-Tax/Corporate-Income-Tax-Filing-Season-2021/

- https://www.iras.gov.sg/irashome/Businesses/Companies/Filing-Taxes–Form-C-S-Form-C-/Late-Filing-or-Non-Filing-of-Income-Tax-Returns–Form-C-S/-Form-C-/

- https://www.iras.gov.sg/irashome/Individuals/Locals/Filing-your-taxes/Errors-in-Tax-Returns/

- https://www.iras.gov.sg/irashome/Businesses/Companies/Paying-Corporate-Income-Tax/Late-Payment-or-Non-Payment-of-Taxes/