If you run a business in Singapore, understanding Goods and Services Tax (GST) is essential, especially as your operations grow.

The rules around registration, compliance, and timing can be more complex, but we will help guide you through.

This guide explains when GST registration is mandatory, and what to do after becoming GST-registered.

Mandatory GST Registration: Who Must Register?

1. Retrospective View – Past Turnover Exceeding S$1 Million

You must register if your taxable turnover exceeded SGD $1 million in the past calendar year (1 January to 31 December). You have 30 days after the year ends to apply to IRAS.

Your GST registration will start on the first day of the second month after year-end. For example, if on 31 December your 2024 taxable turnover exceeded S$1 million, you must apply by 30 January 2025, and registration starts 1 March 2025.

2. Prospective View – Expected Turnover Exceeding SGD $1 Million

You must also register if you expect your taxable turnover to exceed S$1 million in the next 12 months. This expectation should be based on strong evidence such as signed contracts, accepted quotations, or confirmed projects.

*New change effective from 1 July 2025: For forecasts made on or after 1 July 2025, the effective date of your GST registration will be two months after the date you make the forecast, compared to the previous rule where registration took effect just 31 days after the forecast date.

This allows your business additional lead time to adjust their operations, accounting systems, and pricing before GST registration begins.

For example, if you forecast on 1 July 2025, that your taxable turnover will exceed the threshold, your GST registration will start on 1 September 2025.

Note that you must still submit your registration application within 30 days of making the forecast!

It is Possible to Cross the SGD $1 Million Threshold Without Realizing?

Many business owners do not realize their business has grown enough to require GST registration.

Rapid scaling, successful contracts, or seasonal booms may push your taxable turnover past the SGD $1 million mark while you are still celebrating.

This happens because:

• Accounting systems may not track taxable turnover closely

• Gross sales are confused with taxable turnover

• Business owners assume registration is only needed when the business “feels” big enough

If you suspect that your business is reaching this threshold soon, refer to IRAS here on how to proceed with GST registration for your business.

* If your turnover exceeds S$1 million but most of your sales are zero-rated supplies such as exports, you may apply for an exemption from registration.

Exemptions can also be granted if your turnover temporarily crossed the threshold but is expected to fall below it again. You must provide supporting documents like financial statements or client termination letters. However, exemptions would still require formal approval.

Once Registered, Filing is Mandatory

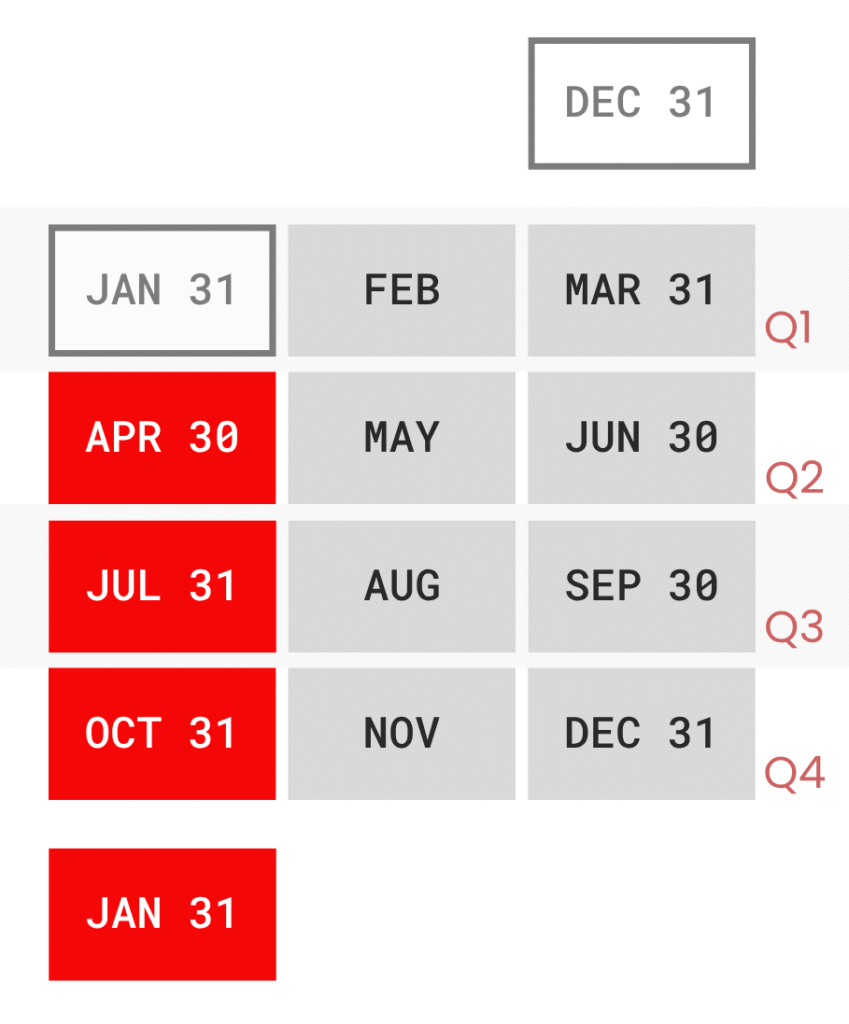

Once you are GST-registered, you are required to file GST returns quarterly, regardless of whether you had taxable transactions during the period. The form must be submitted electronically via the IRAS myTax Portal.

Your return must be filed by the last day of the month following the end of each accounting quarter. For example, if your GST quarter ends on 30 June, your return and payment are both due by 31 July.

You are required to report:

• Output tax (GST collected on sales)

• Input tax (GST paid on business purchases)

• The net GST payable or refundable

Note the exact deadlines for quarterly GST Return filing

*Depending on how your business is structured, You may request a change in your GST filing frequency, such as switching to monthly filing, through myTax Mail in the myTax Portal. This option would still be subject to IRAS approval.

What If Your Business Had No Sales?

Even if your business has no taxable transactions, you are still required to file a “Nil” return. This is a common oversight, especially for newly GST-registered businesses or companies with irregular billing cycles.

Failure to file a Nil return is treated the same as late or non-filing and can still attract penalties.

Risk Penalties and Other Liabilities When You Miss Filing GST Returns

IRAS imposes strict penalties for late or missing GST returns:

• Initial late filing penalty starts at SGD $200 for each missed deadline and increases with each delayed month, up to a maximum of SGD $10,000

• Late payment penalty is 5% depending on various circumstances

• May even result in legal action

Timely filing not only avoids these penalties but also demonstrates good corporate governance to your customers and partners.

Helping you Keep Compliant

At Verti, we help businesses navigate the complexities of GST registration and filing, whether you’re approaching the registration threshold or need help staying compliant with quarterly filings.

Let’s make sure your GST obligations are fully covered.

Reach out to us at contactus@verti.sg or +65 6909 5691 for a free consultation. It’s not too late to get back on track, and you don’t have to handle it alone.

All information accurate as of 23 July 2025