Filing your corporate tax on time is a key responsibility and obligation for all companies incorporated in Singapore, regardless of whether it’s a local or foreign company.

Referred to as Form C/Form C-S/Form C-S Lite, all businesses must file their corporate tax returns by 30 November every year.

This article will provide you with the most updated information on filing practices and address some Frequently-Asked-Questions along the way!

About Corporate Income Tax Returns

The Corporate Tax Returns is filed to IRAS on a Year of Assessment (YA) basis.

A Year of Assessment is the tax year in which the Company’s income tax is calculated and charged. The assessment is for income the Company has earned in the preceding calendar year.

For example: Income taxed in Year of Assessment 2025, refers to income earned from 1 Jan 2024 to 31 Dec 2024. The Corporate Tax Returns for YA 2025 must be filed to IRAS by the due date 30 November 2025.

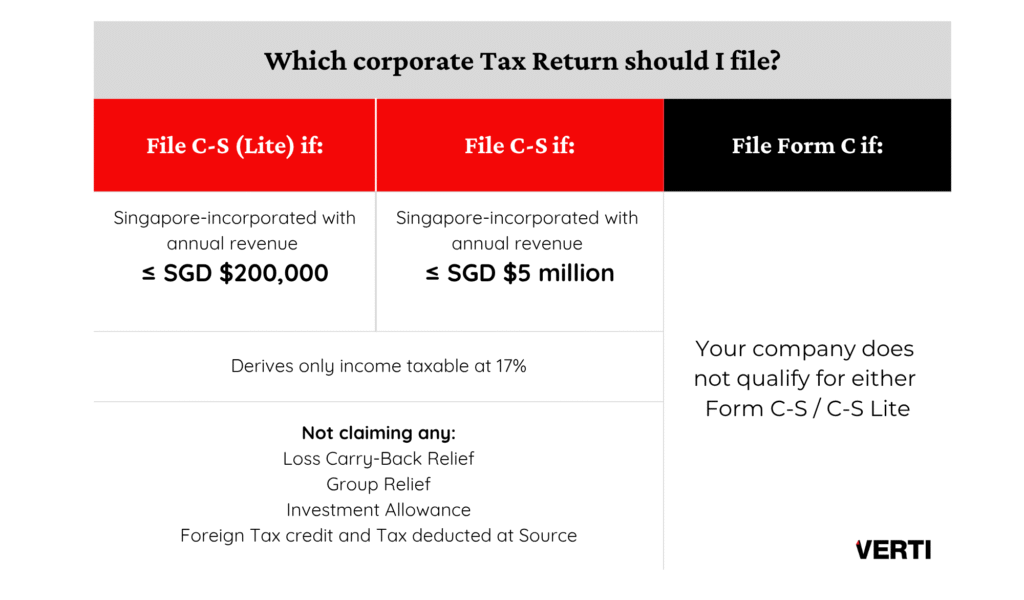

Which of the following corporate income tax return forms your company needs to file depends on your revenue and tax situation:

1 – Form C-S (Lite)

For Singapore-incorporated companies with:

- Annual revenue ≤ SGD $200,000

- Only income taxable at 17% flat rate

- Not claiming tax reliefs or credits:

- Group Relief

- Investment Allowance

- Foreign Tax Credit

- Loss Carry-Back Relief

2 – Form C-S

For Singapore-incorporated companies meeting the same simplified criteria as above except for one condition:

Annual revenue ≤ SGD $5 million

3 – Form C

Used by all other companies that do not qualify for Form C-S or C-S Lite. This form requires more detailed financial statements and tax computations.

*Make sure you are officially authorised in Corppass as an ‘Approver’ for ‘Corporate Tax (Filing and Applications)’ on behalf of your company.

You must also file for Estimated Chargeable Income (ECI)

The ECI is an estimate of your company’s taxable profits for a Year of Assessment (YA), calculated after deducting tax‑allowable expenses from its net profit. All companies must file their ECI within three months from the end of the financial year unless they qualify for an ECI filing waiver.

It pays to file on time as doing so entitles your company to pay tax via instalments under a GIRO plan, with more instalments granted the earlier the ECI is filed, ensuring smoother cash flow through manageable instalment payments.

For detailed step-by-step information on ECI filing, refer to IRAS here.

Avoid any penalties

Failing to file either your corporate tax returns or ECI on time may result in hefty cash fines or even court summons and recovery legal action. You also must make sure that the documents are accurate, as errors could also result in penalties.

Keep your business healthy and in the green! Timely filing not only avoids these penalties but also demonstrates good corporate governance to your customers and partners.

New Tax Rebate for 2025

Good news! In the latest budget announcement, IRAS has introduced a CIT Rebate of 50% of tax payable for YA 2025, capped at $40,000 per company to ease business cost pressures.

It will be automatically computed and applied during the tax assessment process, based on the ECI or tax return form (Form C, Form C-S, or Form C-S Lite) submitted by your company.

Lighting FAQ round

Corporate Tax Rate?

17%

When is the filing deadline?

30 November

What about Foreign Sourced income?

Not subject to tax

* Unless received in Singapore through a Singapore branch or foreign income derived from certain designated territories

How to calculate tax?

Just use the handy IRAS calculator here

Must I file ECI even with no revenue?

Your company does not need to file ECI in any YA only when:

- Annual revenue is ≦ $5 million for the financial year – and –

- ECI is nil for the YA.

Must I file Tax Returns (Form C etc.) even with no revenue?

You must file tax returns every year even when making losses.

Only dormant companies (a company which has no revenue and no trade transaction during the year) can apply for a Waiver to file tax returns..

Helping you keep compliant

At Verti, we help businesses stay on top of their tax obligations – whether you’re filing for the first time or need support keeping up with annual or ECI submissions.

Reach out to us at contactus@verti.sg or +65 6909 5691 for a free consultation. You don’t have to handle it alone.

All information accurate as of 13 August 2025