Is My Company Eligible for Audit Exemptions?

In Singapore, the directors of the company are required to appoint an auditor within 3 months of its incorporation unless it is exempted from audit. On 1st July 2015, a revision in the Companies Act has allowed for small companies to be exempt from the need to perform an annual audit of its accounts, in view of Singapore’s push to support its vibrant business landscape and nurture the growth of more Small and Medium Enterprises (SMEs).

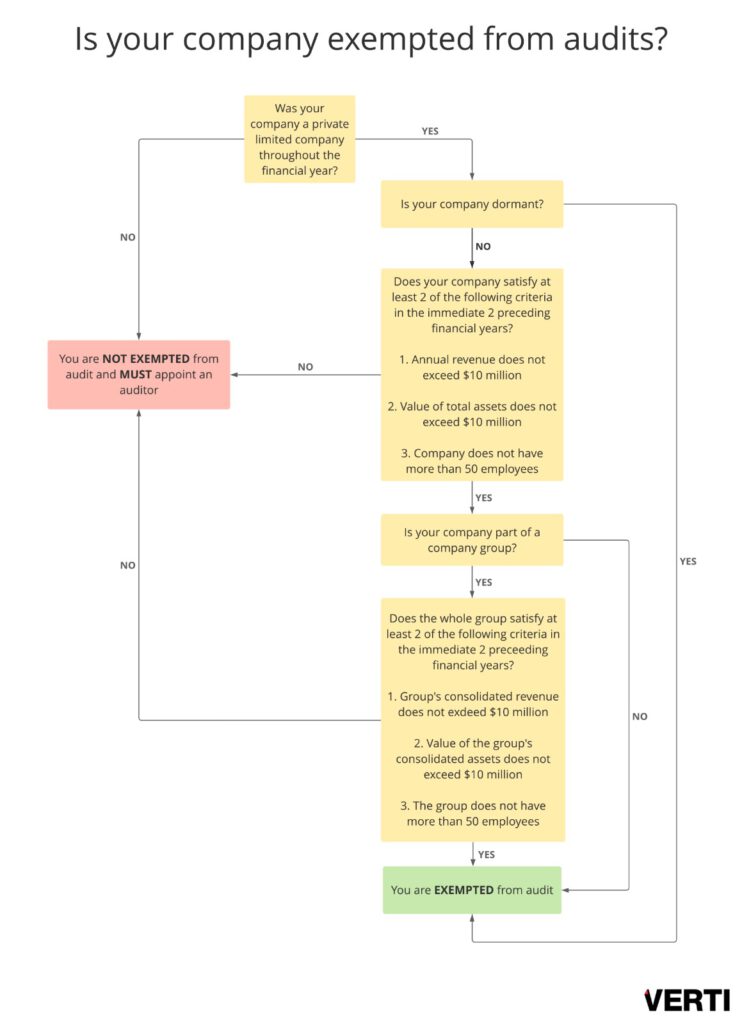

The chart below answers the question of whether your company is exempted from the audit requirements.

What Is Considered a Dormant Company Exempt from Audit?

A company is considered dormant during a period in which no accounting transaction occurs. Such companies will be exempt from audit requirements if:

- It has been dormant from the time of its formation; or

- It has been dormant since the end of the previous financial year.

Dormant companies will cease to be considered dormant once an accounting transaction occurs.

Exception to Exemption from Audit Requirements

Despite being exempt from audit requirements, the Registrar may still require the company to lodge its audited financial statements and an auditor’s report if the Registrar is satisfied that the company has breached laws relating to the:

- Keeping of accounting records; or

- Laying of its financial statements at its AGM.

References

- https://www.acra.gov.sg/legislation/legislative-reform/companies-act-reform/companies-amendment-act-2014/two-phase-implementation-of-companies-amendment-act-2014/more-details-on-small-company-concept-for-audit-exemption

- https://singaporelegaladvice.com/law-articles/company-audits-singapore

- https://sso.agc.gov.sg/Act/CoA1967#Sc13-