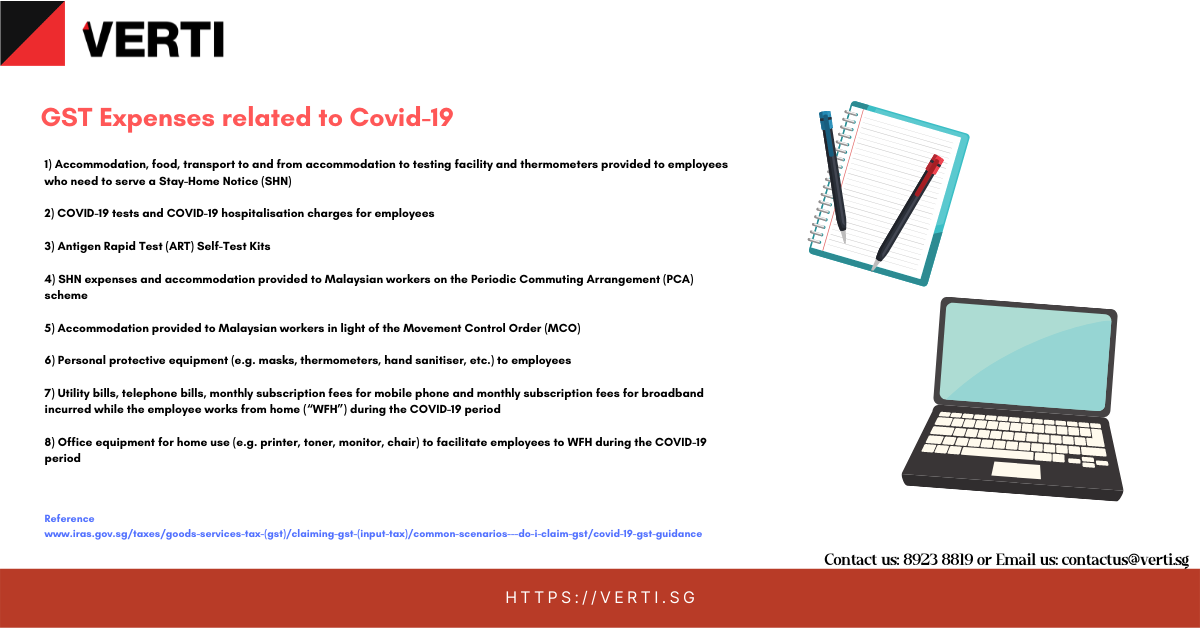

Covid-19 GST Guidance

During Covid-19 Pandemic, your company may have provided accommodation and other types of benefits to your employees. Do you know whether the GST incurred are claimable?

The points below would provide you with some guide:

1) Accommodation, food, transport to and from accommodation to testing facility and thermometers provided to employees who need to serve a Stay-Home Notice (SHN)

Employee who returns from a business trip overseas

Yes. Your employee incurred the expense to carry out the employment duties assigned by your company. However, input tax is not claimable if your company has been providing the same accommodation to your employee prior to 1 Feb 2020, unless the accommodation is allowed under the exceptions or administrative concession under paragraph 7 of the e-Tax Guide “GST: Fringe Benefits” (PDF, 485KB).

Employee who returns from a personal trip overseas

No. The expense is primarily incurred for the personal benefit of your employee. The expense need not have been incurred had your employee not travelled overseas for personal reasons.

2) COVID-19 tests and COVID-19 hospitalisation charges for employees

Input tax incurred on medical expenses is not claimable under Regulation 26 of the GST (General) Regulations, unless the expense is obligatory under the Work Injury Compensation Act (“WICA”).

For example, your employee contracted COVID-19 due to work-related exposure during a business trip overseas. Upon return to Singapore, he is hospitalised and the medical expenses are covered under WICA. Input tax incurred on the medical expenses is claimable.

For COVID-19 tests for employees required to undergo Rostered Routine Testing (“RRT”), the Government will fund the cost of the tests until end 2021.

With effect from 1 Oct 2021, input tax on expenses incurred on the provision of medical treatment is claimable where the medical treatment is provided in connection with any health risk or requirement arising on account of the nature of the work required of your employee or his work environment; and

- – the medical expenses are incurred pursuant to any written law of Singapore concerning the medical treatment or the provision of a medical facility or medical practitioner; or

- – the medical treatment is related to COVID-19 and the employee undergoes such medical treatment pursuant to any written advisory (including industry circular) issued by, or posted on the website of, the Government or a public authority.

For example, if your employee goes on a business trip overseas and you pay for his pre-departure COVID-19 swab tests done in Oct 2021, input tax incurred on the medical expenses is claimable.

3) Antigen Rapid Test (ART) Self-Test Kits

Yes. Self-administered test kits are not considered medical expenses that are disallowed under Regulation 26 of the GST (General) Regulations.

4) SHN expenses and accommodation provided to Malaysian workers on the Periodic Commuting Arrangement (PCA) scheme

No. The expense is primarily incurred for the personal benefit of your employee. For SHN expenses, the expenses need not have been incurred had your employee not returned to Malaysia for personal reasons.

5) Accommodation provided to Malaysian workers in light of the Movement Control Order (MCO)

Yes, you can claim the input tax incurred on accommodation provided to your Malaysian workers who normally reside overseas and are required to reside in Singapore to ensure continuity of your business during the MCO period. However, as accommodation expenses are essentially private consumption in nature, IRAS will allow the GST incurred on accommodation provided up to 31 Dec 2021, provided that your workers have remained in Singapore throughout the MCO period.

6) Personal protective equipment (e.g. masks, thermometers, hand sanitiser, etc.) to employees

Yes. The expense is incurred for the purpose of your business.

7) Utility bills, telephone bills, monthly subscription fees for mobile phone and monthly subscription fees for broadband incurred while the employee works from home (“WFH”) during the COVID-19 period

Input tax is claimable on the business portion of the expense incurred during the COVID-19 period. The supply should be contracted in your employee’s name, and not any other person living in the same household.

Utilities and home telephone bills

If you have difficulties determining the business portion of the expenses, you may take the difference in the amount of expenses your employee incurred before and after working from home and apportion it equally among the working individuals in the same household. For example, if your employee’s utilities bill has increased by $107 (inclusive of $7 GST) and both your employee and another individual in his household work from home, you may claim $3.50 as your input tax.

Mobile phone or broadband subscription fees

If the mobile phone subscription or broadband subscription was used for both business and private purposes during the WFH period, you may claim input tax:

- – For full reimbursements, based on 4/7 of the GST incurred on the expenses.

- – For partial reimbursements, based on 7/107 of the amount reimbursed or 4/7 of the GST incurred on the expenses, whichever is the lower.

8) Office equipment for home use (e.g. printer, toner, monitor, chair) to facilitate employees to WFH during the COVID-19 period

Your company does not own the office equipment

No, input tax is not claimable. The purchase is primarily incurred for private purposes, as your employee can continue to use the asset at home after the WFH period or sell it off without having to obtain approval from your company.

If the company owns the office equipment

Yes, the company may claim the input tax on the purchase.

References